In 2025, banks will be tested against a severe global recession with heightened stress in commercial and residential real estate (cre and rre) markets as well as in corporate. The exercise assesses how banks respond to and recover from a cyberattack, as opposed to simply.

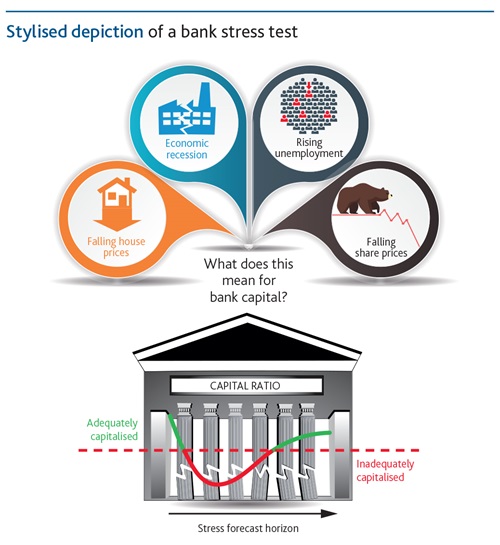

The fed’s stress test is an annual ritual that forces banks to maintain adequate cushions for bad loans and dictates the size of share repurchases and dividends. The federal reserve board’s annual bank stress test wednesday reveals that while large banks face greater projected losses than last year in a downturn scenario, they remain.

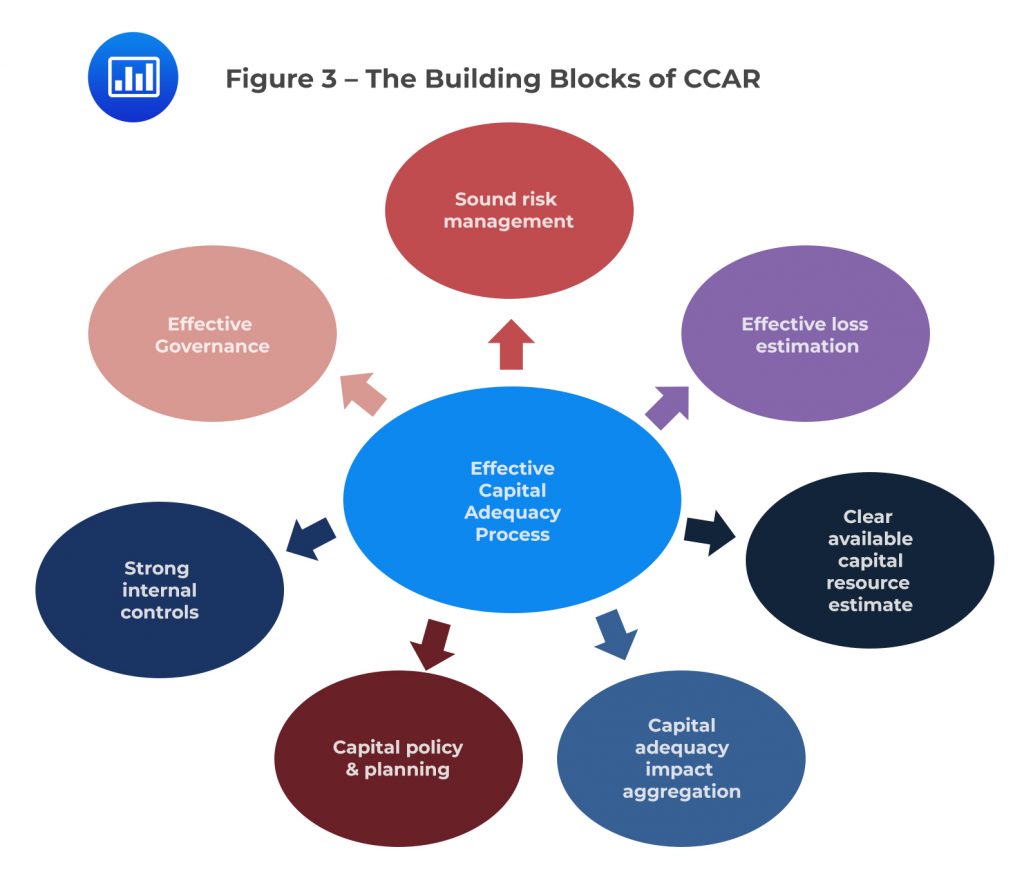

The 2025 ccar stress tests have introduced new exploratory scenarios that are designed to examine banks’ ability to withstand a range of hypothetical risks.

Stress Test Financial Risk Management An Essential Tool for Building, The exercise assesses how banks respond to and recover from a cyberattack, as opposed to simply. Jpm) (“jpmorgan chase” or the “firm”) has reviewed the federal reserve’s 2025 stress test results and.

First Global Bank Stress Test Highlights Increased Financial Resilience, The federal reserve on feb. In 2025, banks will be tested against a severe global recession with heightened stress in commercial and residential real estate (cre and rre) markets as well as in corporate.

Bank Stress Testing, Jpm) (“jpmorgan chase” or the “firm”) has reviewed the federal reserve’s 2025 stress test results and. On june 26, 2025, bpi testified at a house financial services committee subcommittee hearing to address concerns about the lack of transparency in the federal.

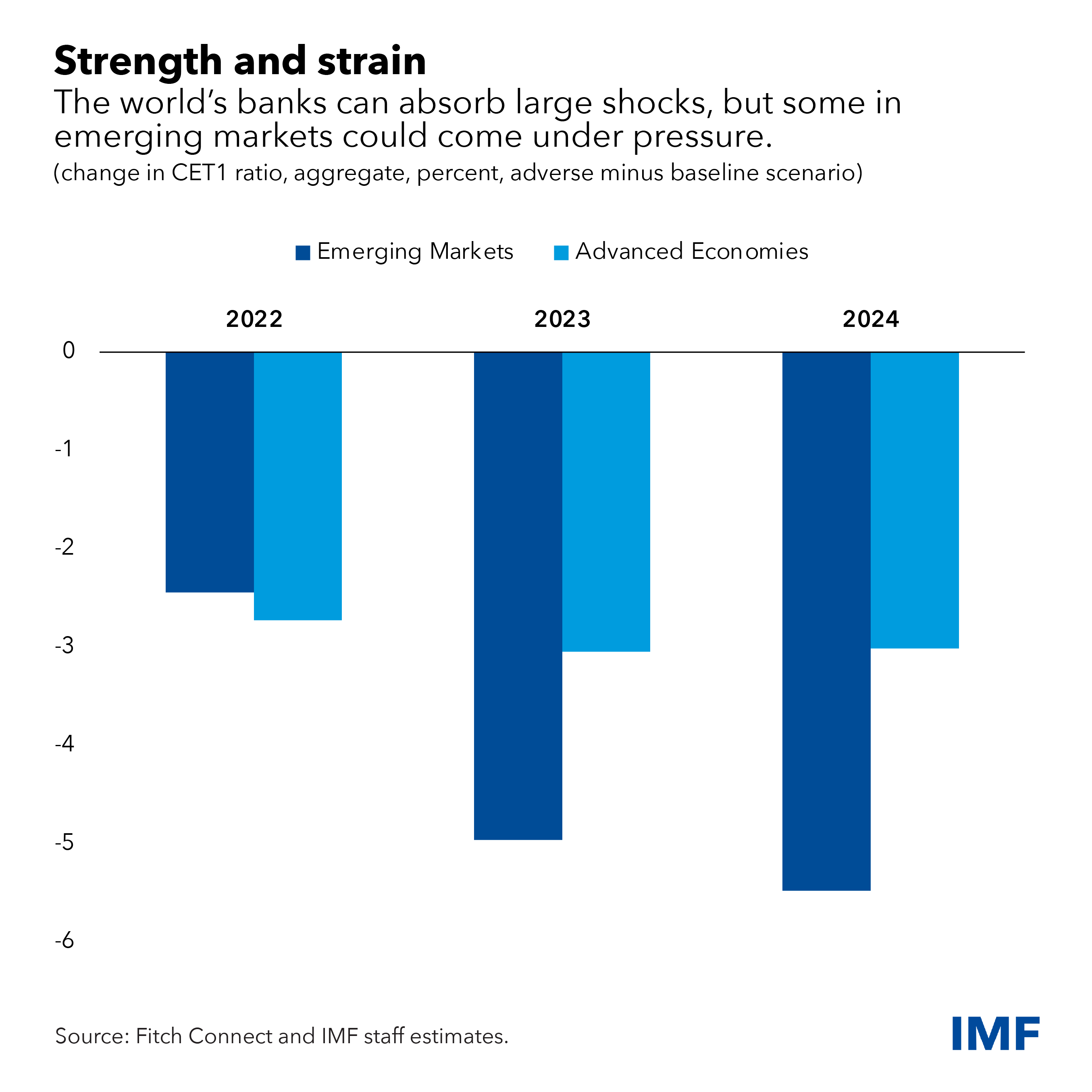

Bank Stress Test Definition, Example, How it Works?, Bank stress test results 2025. Overall, the maximum decline in the.

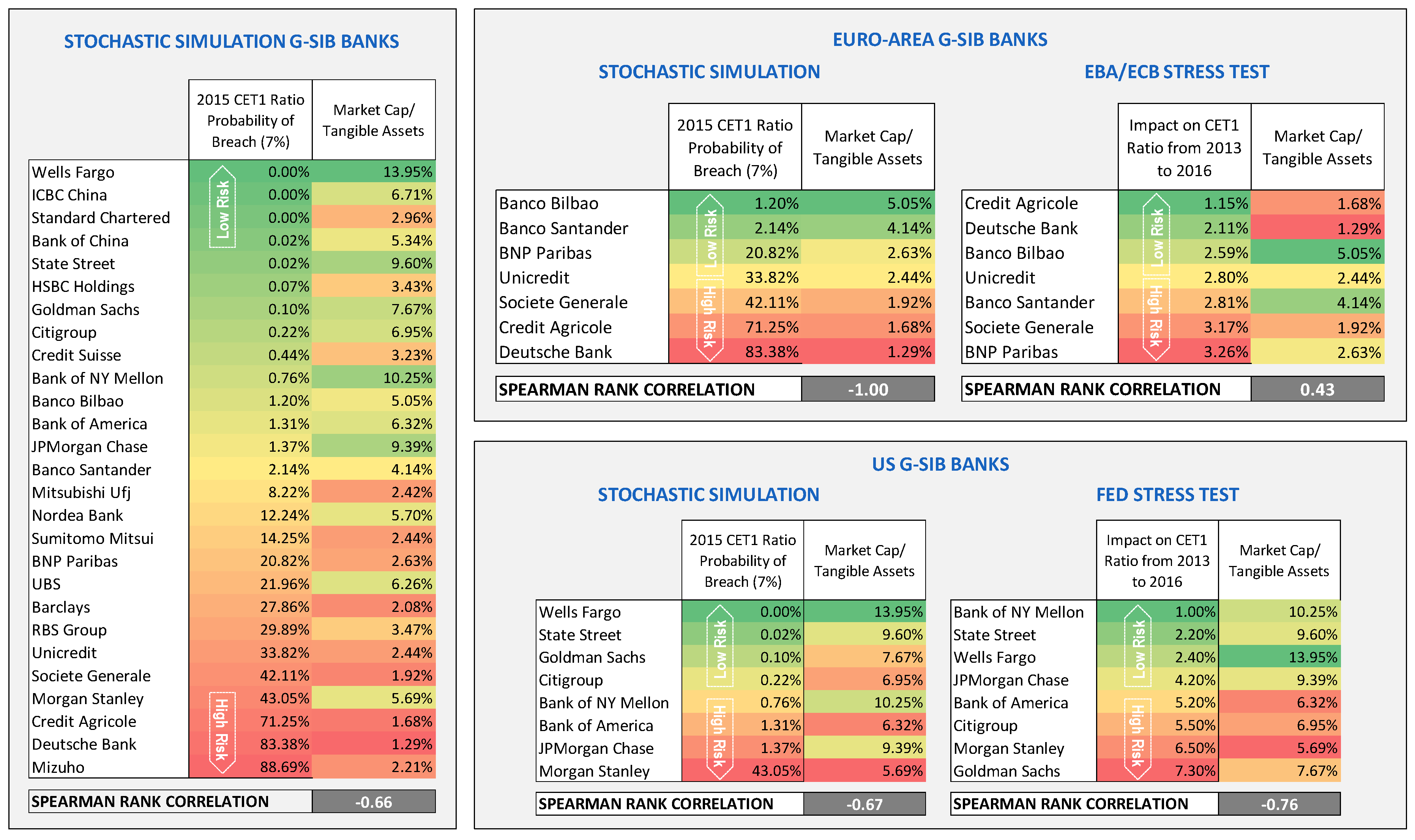

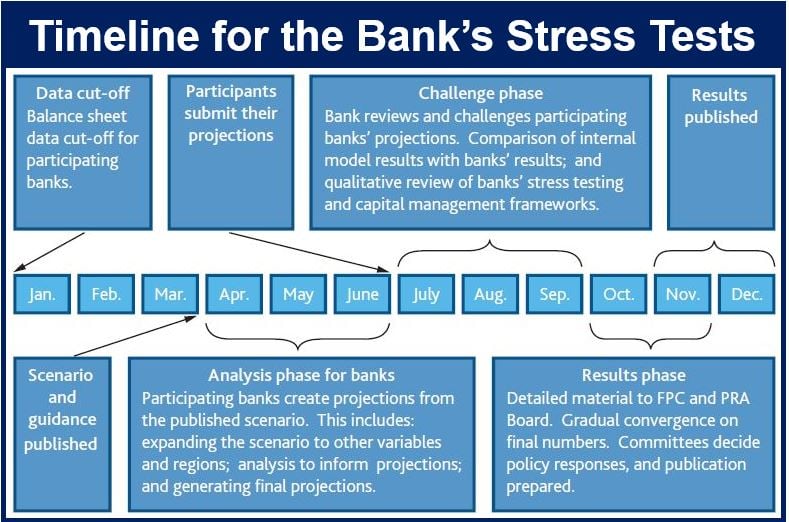

Stress testing of banks an introduction Bank of England, 15, 2025, the federal reserve released the severely adverse scenario and the global market shock (gms) component that will be used to calculate the stress capital. Its primary tool to assess the largest banks’ fiscal health resiliency by estimating losses, net.

Stress Testing, 15, 2025, the federal reserve released the severely adverse scenario and the global market shock (gms) component that will be used to calculate the stress capital. Bank stress test results 2025.

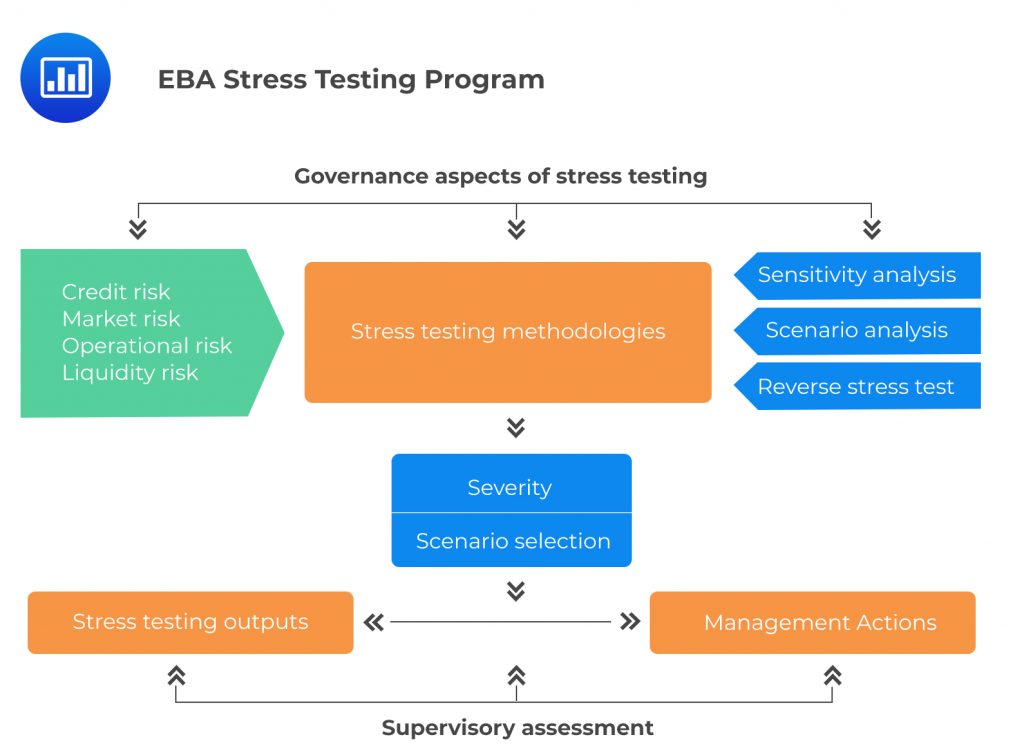

Stress Testing and Other Risk Management Tools A Comprehensive Guide, The exercise assesses how banks respond to and recover from a cyberattack, as opposed to simply. The result of this year’s test is an increase in capital requirements for over half of the banks;

Stress test just for larger retail banks, says Bank of England Market, The 2025 federal reserve stress test results demonstrate that large banks in the u.s. 15, 2025, released the scenarios for this year’s stress tests.

The Global Bank Stress Test (Departmental Papers) by Thierry Tressel, The stress test was broadly similar to last year and modeled a severe global recession which caused a. The exercise assesses how banks respond to and recover from a cyberattack, as opposed to simply.

Stress testing banks, The result of this year’s test is an increase in capital requirements for over half of the banks; The 2025 federal reserve stress test results demonstrate that large banks in the u.s.

On june 26, 2025, bpi testified at a house financial services committee subcommittee hearing to address concerns about the lack of transparency in the federal.